You can also deduct 100 percent of medical, vision, and dental premiums.

Tax deduction independent contractor expenses professional#

Business insurance, such as a professional liability policy, is a common example. InsuranceĪny insurance that you purchase for your business is deductible. Depreciation is the recovery of the cost of the property over a number of years.Īs a contractor, you can deduct a portion of the cost every year until you fully recover the total cost of your equipment. Instead, you generally must depreciate such property. You generally can't deduct in one year the entire cost of property you acquired, produced, or improved and placed in service for use either in your trade or business or income-producing activity if the property is a capital expenditure. This makes it easier to deduct the expense when tax season rolls around. Keep your business internet and cell phone bills separate from those that you use for personal reasons. Working from home means you’ll rely heavily on the internet and phone to communicate with prospects, customers, and suppliers among others. It’s never fun to spend money on legal and accounting services, but it’s often necessary.

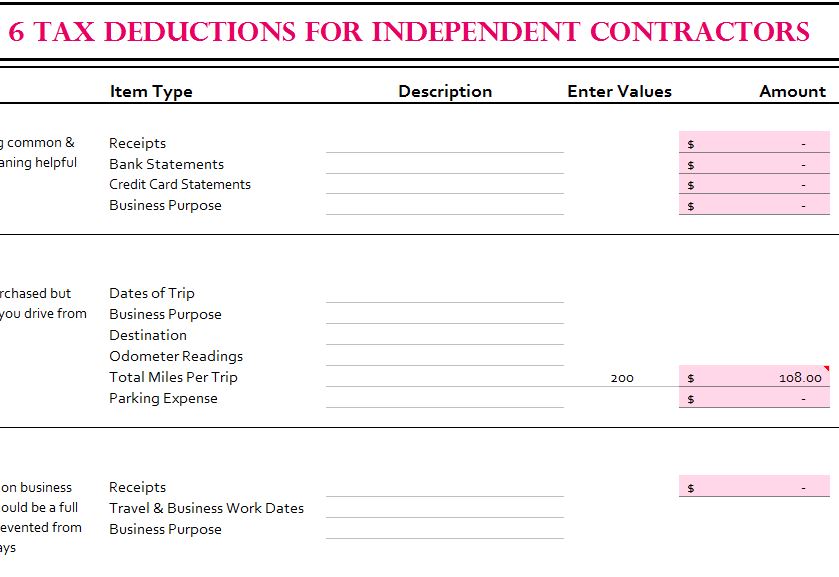

Maybe you generate business via online advertising. Advertising and marketing costsĪny money you spend advertising or marketing your business can be written off. When deducting travel expenses, it’s important to keep close tabs on which ones are related to business and which ones aren’t. Also, 50 percent of your meal costs can be written off as business expenses. This includes mileage, airplane tickets, car rental, and hotel. If you do any sort of traveling for your business, keep close track of your travel expenses so you can deduct them on your tax return.

In addition to the space itself, there are direct expenses such as: Most contractors work from home, which allows them to take a home office deduction. It does not affect either your net earnings from self-employment or your self-employment tax. This deduction only affects your income tax. You can deduct the employer-equivalent portion of your self-employment tax in figuring your adjusted gross income. Here’s how the IRS explains the self-employment tax deduction: For example, a $5,000 self-employment tax payment reduces taxable income by $2,500. You can claim 50 percent of what you pay in self-employment tax as an income tax deduction. There’s a good chance that several of these will pertain to you. Here’s a list of the most common taxes independent contractors can deduct. You don’t want to miss out on something that could reduce your tax liability. While you may not qualify for every deduction, it’s important to at least consider your options. There’s no shortage of deductions for independent contractors. What taxes can independent contractors deduct? This generally means making quarterly payments throughout the year. You don’t have an employer to withhold taxes and pay on your behalf, so you’re responsible for managing the entire process. Self-employment tax (a combination of Medicare and Social Security taxes)Īs noted above, it’s your responsibility to pay the self-employment tax.What taxes do independent contractors have to pay?īefore we dive into tax deductions as an independent contractor, let’s talk about the types of taxes that you have to pay. You don’t want to make a mistake that could get you in hot water with federal or state tax authorities.

Of course, with the IRS watching closely, you must make sure that you only deduct qualified expenses. Doing so reduces your tax liability, thus allowing you to keep more money in your pocket. In other words, there’s no employer to withhold federal, state, and local taxes.Īlong the same lines, there are expenses you can write off as an independent contractor. One of the things you must understand from the start is that you’re responsible for managing your own taxes. There are various pros and cons of working as an independent contractor.

0 kommentar(er)

0 kommentar(er)